UK Government-Backed Company Fuels Gas Power in Africa

A Fuel for Africa?

A little-known company that is majority-owned by a UK government development body and backed by UK aid money has been pouring investment into gas power across Africa.

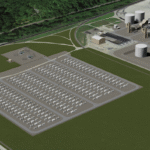

Globeleq runs 1,119 megawatts (MW) of gas power plants in Cameroon, Ivory Coast, and Tanzania. These sites make up more than two-thirds of its total energy portfolio.

The company is controlled by the UK government-owned development finance institution British International Investment (BII), which receives funds from the UK aid budget. Globeleq has received hundreds of millions of dollars of investment via BII over the years.

BII stresses Globeleq’s role in providing reliable power to many of the millions of Africans who would otherwise lack electricity access. It also points to its own efforts to drive a “pivot towards renewables” within the company.

Gas Expansion

Globeleq describes itself as “the leading independent power producer in Africa”. It currently has roughly 1,794MW of electricity generating capacity across several African nations.

More than two-thirds of this capacity – 1,207MW – comes from fossil fuels. This mainly consists of three gas power plants in Cameroon, Ivory Coast, and Tanzania, as well as an 88MW heavy fuel oil plant in Cameroon.

Globeleq and BII

Globeleq, which has a head office in London and a registered office in Guernsey, was originally set up in 2002 by the UK Department for International Development (DFID), a precursor to the Foreign, Commonwealth and Development Office (FCDO). It was part of a broader strategy to support the private sector in developing countries.

Since then, the company has undergone changes in focus and ownership. Having sold off its assets in other emerging markets, Globeleq now works exclusively in Africa.

As of 2015, 70% of Globeleq’s shares are held by BII, formerly known as CDC Group. According to reporting by Bloomberg, BII’s stake in Globeleq’s portfolio of gas power plants and other projects is valued at around $1bn.

The remaining 30% of its shares are held by Norfund, Norway’s development finance institution. BII is 100% owned by FCDO, but says its “day-to-day operations and investment decisions are independent of government”. The institution is supported primarily through returns from its existing investments, as well as new injections of funding from the UK aid budget.

Globeleq is BII’s main subsidiary for power sector development, and in 2020 NGOs flagged it as a major component of the UK’s fossil-fuel spending overseas. Over the past decade, analysis by aid agency CAFOD concluded that BII had committed hundreds of millions of dollars towards Globeleq energy projects – primarily based on fossil fuels.

‘Conflict’ with Climate

The involvement of the UK’s government and money in BII and Globeleq has raised questions about the nation’s pledge – alongside other major economies – to stop overseas fossil-fuel investment.

Under the previous Conservative government, the UK committed to ending new overseas fossil-fuel funding beyond March 2021. Globeleq’s Temane power plant in Mozambique reached financial close in December 2021.

However, both the government, and BII itself, included exemptions in their pledges – dubbed “loopholes” by some observers – that allow for continued funding of some gas power plants if they align with achieving net-zero emissions by 2050 and “cannot viably be replaced” by renewables. The Temane project was deemed to fit these criteria.

Conclusion

African countries are home to nearly 600 million people without electricity access, leaving them vulnerable to fuel price spikes and health impacts. The UK government-backed Globeleq company has continued to invest in gas power in Africa, despite government pledges to stop overseas fossil-fuel investment. African civil society groups have voiced concerns that this investment would “lock in” gas power, making it challenging for countries to transition to renewable energy sources.

FAQs

Q: How much of Globeleq’s energy portfolio comes from gas power?

A: Around 85% of its total energy portfolio comes from gas power.

Q: How much has BII invested in Globeleq energy projects?

A: CAFOD analysis concluded that BII had committed hundreds of millions of dollars towards Globeleq energy projects – primarily based on fossil fuels.

Q: Are there any exemptions for further funding of gas power in the UK’s fossil-fuel spending pledge?

A: Yes, the UK and BII included exemptions allowing for continued funding of gas power plants if they align with achieving net-zero emissions by 2050 and “cannot viably be replaced” by renewables.

.png?w=150&resize=150,150&ssl=1)

.png?w=150&resize=150,150&ssl=1)

.png?w=150&resize=150,150&ssl=1)